This commentary is a part of the April 2020 issue of Igaming Focus.Jake Pollard is an experienced freelance gaming journalist. He is based in London, UK, and covers all business and regulatory topics relevant to online gaming and betting companies.Campaigning by politicians and pressure groups against the igaming sector will continue after COVID-19 is over. Operators must have the data to back up their responsible-gambling credentials.Has the predicted boom in online casino gambling actually happened since the COVID-19 lockdowns have come into force? Has there been, as some critics forecast, a marked rise in problem gambling incidents and major failings from operators when it comes to responsible-gambling policy and player safety during this crisis?To a large extent, opinions will depend on whom you follow on social media and which news outlets you believe. This is because, as in politics, confirmation bias seems to play as significant a role in what policy makers and the public believe on these issues as do data, evidence and statistics.If someone thinks gambling is ‘the root of all evil’, no amount of data indicating that operators are doing the right thing will change their mind. At the same time, some industry executives insist that operators have gone beyond the call of duty and could not have done more in their responsible-gambling efforts.The truth as ever lies somewhere between those two extremes, but the debate does encapsulate the general atmosphere surrounding online casino gambling in many European markets.When it comes to business activity, H2 Gambling Capital’s COVID Tracker forecasts that the land-based sector will suffer a 60%-65% drop in gaming gross win, while online gaming revenues will rise 30%-35% between March and May under current lockdown restrictions.Sports betting will be hard hit: H2 forecasts a 13% drop in offline gross win for 2020 compared with 2019, although online is forecast to experience ‘only’ a 4% drop in gross win this year.

Ongoing campaigns

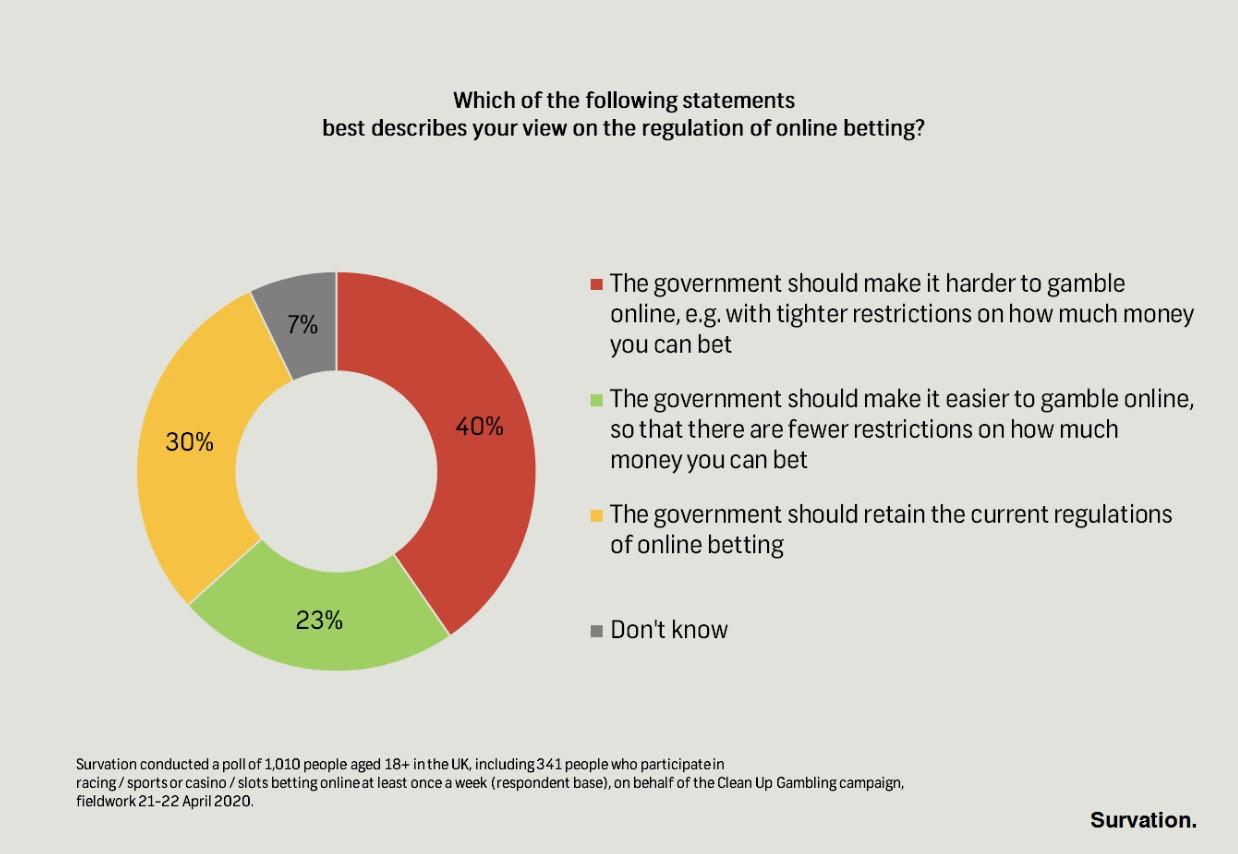

Returning to igaming, precise figures relating to how much players have staked online during the lockdown are not yet available. Calls to make it harder to access the products, however, receive plenty of media coverage, even if the predicted rise in online casino gambling, accompanied by the feared rise in problem gambling, debt and addiction, has not been proven (or disproven).As much as anything, the debate is another chapter in the ongoing propaganda war between anti-gambling advocates and the industry that is being played out in markets like the UK, Spain and Sweden. The reasons for this state of affairs are specific to each country.For example, Spain recently banned all gambling advertising, with operators also not allowed to offer bonuses and free bets or incentivise gambling throughout their marketing texts. Contacts there have said the arrival of a new government in November has led to an anti-gambling atmosphere that seems driven as much by ideology as by its stated aim of wanting to protect players from harm.In Sweden, the regulator Spelinspektionen has issued strict fines over bonusing, affiliate advertising and offering bets on unauthorised markets since full igaming regulation was introduced at the start of 2019. In turn, operators have complained of unclear guidelines and have pointed to the timings of the regulator’s measures, which often occur following criticisms from the state operator Svenska Spel.In the UK, the Betting and Gaming Council, which represents 90% of the igaming sector, this week said it would voluntarily cease all advertising on TV and radio for the remainder of the lockdown. The immediate response from politicians and pressure groups has been that the industry should have adopted this measure on day one.Another example of this anti-gambling campaigning in the UK is the survey commissioned by the pressure group Clean Up Gambling set up by Matt Zarb-Cousin and backed by Derek Webb. Both were behind the Campaign for Fairer Gambling, which was highly effective in lobbying against fixed-odds betting terminals (FOBTs) and getting the government to adopt the £2 maximum stake that came into effect in April 2019.Publishing the results of a COVID-19 survey it commissioned from polling company Survation, Clean Up Gambling said a plurality of regular gamblers were betting more:

- 39% since the start of the outbreak, while

- 25% were betting the same, and

- 34% were betting less.

When it comes to online regulations:

When it comes to online regulations:

- 40% of regular online gamblers said the government should make it more difficult to gamble online, compared to

- 23% who said it should be made easier, and

- 30% who said current online regulations should stay the same.

In response, the European Gaming and Betting Association was quick to point out that those results revealed very different and encouraging trends — that players were in fact gambling the same or less (59%) and that a majority (53%) “think government should keep, or ease, online gambling regulations; not restrict further”.

In response, the European Gaming and Betting Association was quick to point out that those results revealed very different and encouraging trends — that players were in fact gambling the same or less (59%) and that a majority (53%) “think government should keep, or ease, online gambling regulations; not restrict further”.

On the contrary, the poll ACTUALLY shows:

– Most people (59%) gambled less, or the same, since beginning of coronavirus lockdown (most of which gambled less); not more.– Most people (53%) think government should keep, or ease, online gambling regulations; not restrict further. https://t.co/ld03vwDzmE— EGBA (@EUgambling) April 25, 2020

EGBA reached these very different conclusions by simply adding the two neutral percentage figures:

- 25% of respondents said they were gambling the same as before and 34% said less (59%),

- 30% of respondents said the government should retain the same regulations and 23% said it should be easier to gambling online with fewer restrictions on how much money players can bet (53%).

Which just goes to show, survey figures can be interpreted in many different ways.

Vital data

At this unprecedented time, however, online casino products represent vital revenues (and jobs) for the igaming sector. Operators are also keen to point out they are doing all they can to prevent gambling-related harm.The subtext here is that while past cases have found some major brands seriously wanting in their social-responsibility and anti-money-laundering commitments, they would gain nothing from exploiting players at this time and will do all they can to avoid such failings.But whether it is stopping TV and radio advertising (voluntarily or not) or increasing funding for the treatment of problem gambling or the number of responsible-gambling messages, it is impossible to tell how the industry will come out of this extraordinary period.The hope is that once out, the data will show operators practised what they preached and the responsible-gambling claims stack up, because the campaigning against them won’t stop once we have come out of COVID-19.